Risk in Real Estate Development

- Topic

- Inspiration & Information

- Date

- 07.07.2022

We were recently asked how we feel about all the increasing uncertainties and risks in our world right now. Our answer: We feel good! Because if we didn’t take risks, we wouldn’t be able to provide homes for our customers, returns for our investors, and jobs for our employees.

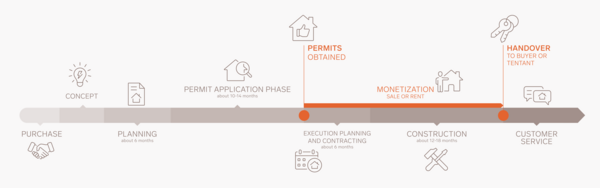

Real estate development is a relatively long-term affair, which means that short- and medium-term political and societal events hardly affect us. For example: It may feel like COVID-19 has been with us for an eternity, and yet an average project that started during the first wave in Austria would only be about halfway through its development by now. illustrates, even something as impactful as the pandemic has had relatively little effect on real estate development. Overall, risks can usually be managed through knowledge, skill, and steady work.

Put simply, the business risks that arise over the typical course of a project can be divided into three different groups:

Permitting, construction, and monetization

Permitting Risk

or: “What would life be if we didn’t have the courage to take risks?” (Vincent van Gogh)

At the start of most projects we often encounter what we call a political risk: the question of whether a planned project concept will actually be approved. In this category, it is important to distinguish between rezoning projects and projects with no change in dedicated purpose.

For projects that don’t require any type of rezoning, the risks are limited to longer response times from building authorities or alternate interpretations of a draft, things that can usually be cleared up fairly quickly. Of course, no real estate developer is going to be happy about, for example, a 10 percent increase in project duration. However, since interest on Austrian projects is relatively manageable—accounting for around 5–10 percent of total investment costs, this kind of delay remains acceptable from a risk perspective.

For projects that require rezoning, the risks are significantly higher and the timelines much longer, but can also be easily managed through experience, foresight, and patience.

Rezoning is often seen as some kind of mysterious process. In reality, however, permitting procedures follow relatively clear rules, often making it possible for people familiar with architecture and zoning policy to estimate outcomes.

For us as developers, it is important to not only consider how things benefit us, but to also advance developments in consultation with building authorities and to ensure they benefit the public as a whole.

Construction Risk

or: “And the day came when the risk to remain tight in a bud was more painful than the risk it took to blossom.” (Anaïs Nin)

After a project has been approved, the contracting process for construction services begins. Good consultants and professionals are always in high demand and short supply. In the end, only two things are helpful here. First, always keep an ear out for what’s happening in the market. Even very good professionals sometimes have availability open up when a job falls through, and sometimes they are able to fit in a smaller project between others. Second, always be a fair partner. That way, former project partners will not only be happy to come back, they may even recommend us as clients. A fair partnership includes awarding a contract based upon a well-thought-out construction plan that makes it possible to accurately estimate construction costs.

The current situation—material supply bottlenecks and increased construction prices triggered by the pandemic combined with the war in Ukraine—is exacerbating this issue for the entire industry. Many nonprofit organizations have had to put projects on hold, which, on the other end, frees up construction company schedules a bit and makes materials more available. Prices have also become more stable, albeit at a slightly higher level.

Monetization Risk

or: “If we want to achieve something, we have to take on risk.” (Ernst Happel)

The third risk is that of monetization, i.e. whether a developed project can actually be sold or rented at the calculated price. Monetization risk is particularly high in the uppermost luxury segment, an area that we deliberately avoid. We create high quality at fair prices. And we make sure to give our customers enough time to be truly confident of our products and the price/performance ratio we offer.

In this phase, too, no real estate developer is happy to have standing vacancies long after a project’s completion. However, because of the relatively low interest rates, such vacancies really wouldn’t endanger the company financially in any significant way. And if it ever should happen that we can’t sell all our apartments, we can always rent the apartments and use the income to reimburse our financing partners. Our solid equity base and good banking network are both beneficial here.

Real Estate Development

or: “The rejection of a risk is the greatest risk for a company.” (Reinhard Mohn)

By no means are we trying to minimize the fact that real estate development does indeed involve risk. However, 100% risk-free investments would also not justify the attractive interest rates we offer our mezzanine capital and private investors.

Our dedication to the AVORIS focus, our company code of ethics, ensures that our portfolio includes only sustainable and holistic projects that are built to last. And thanks to the risk-management approaches described above, we have not yet had a project fail.

We assure you that we work hard every day to keep it that way. We have a responsibility to our customers, to our investors, and—ultimately—to ourselves, because we love our jobs.